Explaining Historic Tax Credits

For as many places of life and energy you see throughout your community, you also see places of what once was. These run-down buildings often sit in prime urban areas, but are neglected by developers due to the high cost of bringing them up to code. The result is not only an eyesore to the community, but also a loss of opportunity. Enter Historic Tax Credits (HTCs), which incentivize developers to reinvest in these spaces and restore life to those areas.

The Historic Tax Credit Program was developed by the National Park Service (NPS) and Internal Revenue Service (IRS) in 1976 as a way of facilitating the reuse of our country’s most historic properties and stimulating local economies. When a developer completes a rehabilitation project on a certified historic structure, the federal government will award HTCs equal to 10 or 20% of the development cost.

Not every old building is eligible for an HTC. To qualify for the credits, a property must produce income or be used by an income-producing organization. The property must also be considered historic or have been built before 1936.

These conditions also determine the amount of HTCs awarded. If the building meets the above historic standards, the redevelopment is eligible for a 20% HTC. If not, the building may still be eligible for a 10% HTC if it was built before 1936 and your redevelopment creates income.

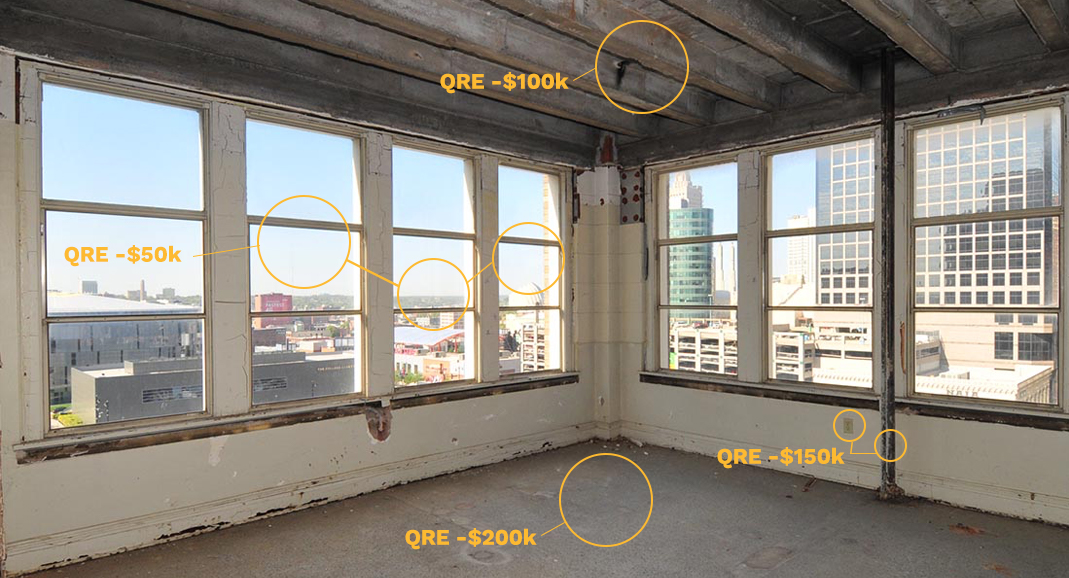

Once you determine which HTC credit you qualify for, you can estimate the actual credit amount. The IRS will only allow qualified rehabilitation expenses (QREs) to fall under the tax credit, those expenses that directly relate to the improvement of the building’s structural quality.

The government doesn’t hand out HTCs to every fixer upper building. In order to qualify for an HTC, your rehab project must meet the Secretary of the Interior’s standard of “substantial.” That means an investment equal to the the adjusted property basis, or $5,000–whichever is greater. View the Department of the Interior’s complete standards for rehabilitation here.

Managing a historic rehabilitation project is a complex, time-consuming task. You shouldn’t go through it without an experienced team of consultants, attorneys and accountants making sure everything goes according to plan. Trust the Sunflower Development Group team to handle every aspect of your project from start to finish.

Reach Out