Explaining New Market Tax Credits

Look around your community and you’re sure to find places that need a little help, whether it’s more commercial construction, more living wage employers or even more housing. These communities are prime opportunities for developers to build something that fosters ongoing development, but they often come at a high price and high financing gap. New Market Tax Credits (NMTCs) help offset the financial cost of investing in new areas, so you can get right to building. Here’s what you should know about the New Market Tax Credit financing structure.

Congress approved the New Market Tax Credit in 2000 as a way to attract investment in low-income communities and bolster nearby business development. The credits are managed by the Department of the Treasury and are awarded to community intermediaries, who then select investment projects.

Who gets New Market Tax Credits?

New Market Tax Credits are awarded to community development entities (CDEs) and community development financial institutions (CDFIs). These groups have a mission to assist low-income communities by supporting social programs, providing development assistance and financing projects in distressed communities.

A CDE or CDFI must be certified by the federal government and demonstrate that its core purpose is to serve and advocate for residents of low-income communities.

The majority of NMTC awards are provided to:

What areas are eligible for New Market Tax Credits?

The government stipulates that NMTCs may only be awarded to communities in “distressed” census tracts where median family income is below 80% of the area’s median income (AMI), or where the poverty rate is 20%.

However, the vast majority of NMTC recipients commit to only invest in “highly distressed” census tracts, which include one of the following:

How are New Market Tax Credits allocated?

A CDE first applies to the Treasury Department for an allocation of NMTCs. Their application will indicate how and where it will invest its allocation of NMTCs. Roughly 275 CDEs compete for $3.5 billion of NMTCs annually, with roughly 75 receiving an award. CDEs apply with a general pipeline of projects in which they intend to invest. Typically, those CDEs will continue to seek projects that will support their mission and maximize the community benefits.

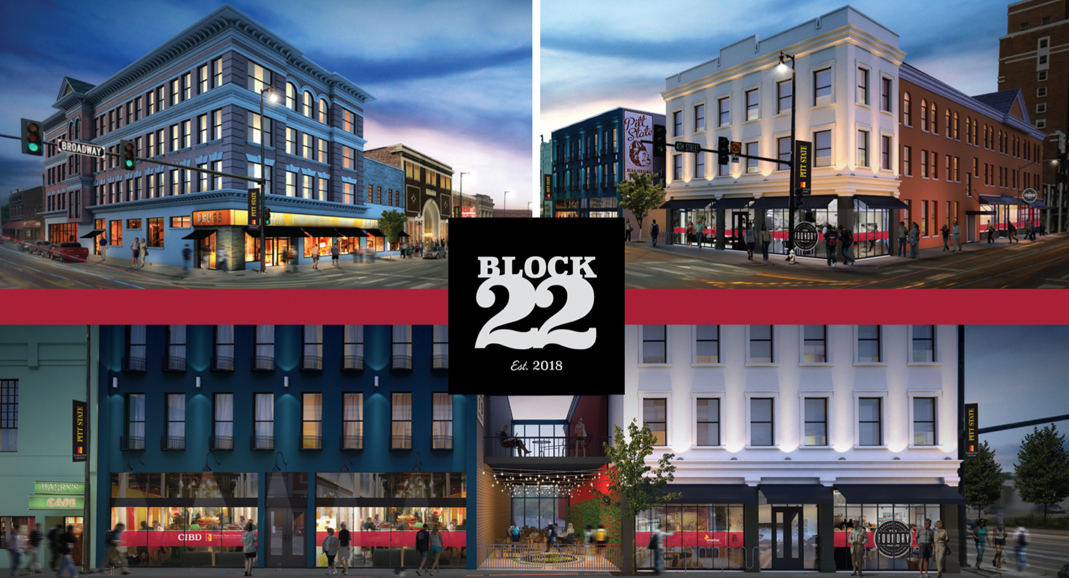

Common NMTC projects include:

NMTC projects range in size and scope across the country, and not every project located in an eligible census tract is an attractive to a CDE. Instead, CDEs evaluate projects on a criteria given to them by the Treasury Department to ensure they are using the NMTC to support its intended purpose. The NMTC system is very nuanced and any project sponsor should understand what makes a project attractive to a potential CDE.

What is the benefit of New Market Tax Credits?

As a rule of thumb, the net benefit a project will receive after all costs are paid over the 7-year compliance period is between 17%-20%. On a $10 million NMTC investment a project sponsor can count on between $1.7 -$2 million in the form of an assumable soft loan to the project. Once assumed, the project sponsor can pay down the loan to itself over an extended amortization period or forgive the loan to itself.

Common uses of NMTCs include:

Don’t go at it alone. We’ve seen sponsors spend time and money trying to learn and navigate the NMTC program without success. They simply didn’t know what they didn’t know. Let Sunflower Development Group’s team of New Market Tax Credit consultants guide the process for you and get your project one step closer to breaking ground.

Reach Out