Opportunity Zones: What You Need to Know

In 2017, Congress passed the Tax Cut and Jobs Act, which included a series of incentives designed to promote new real estate development in some of the country’s most distressed areas. These areas are called “Opportunity Zones” and could present a significant revenue opportunity for the right real estate developers. Let’s take a look.

What are Opportunity Zones?

Opportunity Zones refer to low-income census tracts that are eligible to receive financial assistance under the Tax Cuts & Jobs Act. In order to be eligible, the tract must align with the stipulations outlined under the New Market Tax Credit. This means the tract includes both of the following:

Additionally, the state’s governor nominated the census tract to receive the Opportunity Zone label. Governors were able to nominate up to 25% of their state’s eligible tracts to receive Opportunity Zone funds. The Opportunity Zones have been approved nationwide and it is unlikely any new opportunity zones will be nominated in the future.

What are Opportunity Zone Properties?

Under the Act, taxable investors are encouraged to reinvest their capital gains from asset sales into a Qualified Opportunity Zone Property (QOZP). As long as the transaction occurs within 180 days of the asset sale, the property will be eligible for several tax benefits. A Qualified Opportunity Zone Property is defined as:

How do Opportunity Zones Work?

The Opportunity Zone Fund is a great way for real estate developers to finance projects in distressed areas, such as urban infills or historic renovations. Once capital gains are invested into a QOZP, the property is eligible for three significant benefits. Advantages of Opportunity Zones include:

How to Invest in Opportunity Zones

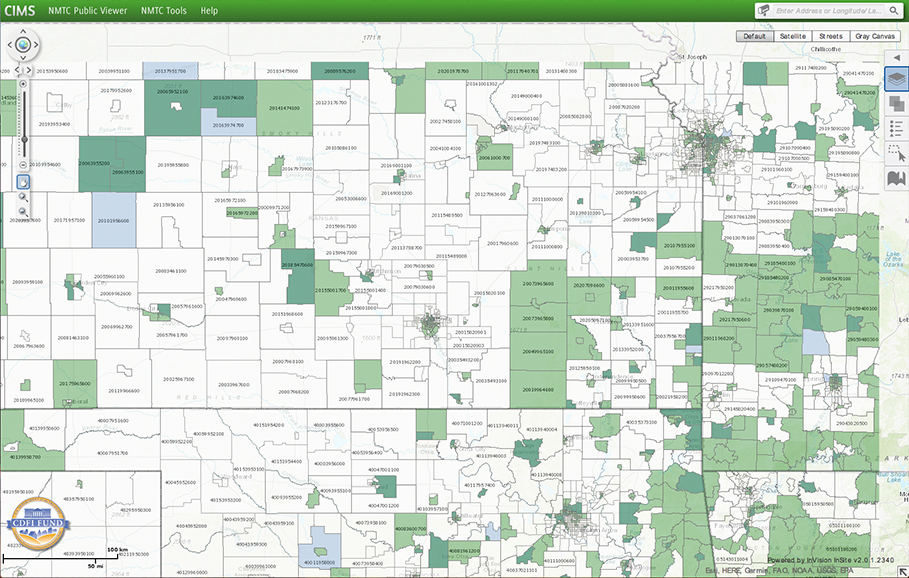

Investing in an Opportunity Zone is as simple as investing in a QOZP. Real estate developers should use the CDFI Fund’s Opportunity Zones map and consider how they may use these new incentives to their advantage. Before investing in an Opportunity Zone, developers should also understand the long-term risks and benefits associated with distressed census tracts.

Like any federal program, it takes time and expertise to navigate the Opportunity Zone Fund and maximize its benefits. Let the Sunflower Development Group show you how it’s done. We’ll guide the process for you from start to finish as we bring your project to life.

Reach Out